Why choose Jusan

“We believe that the investment strategy we have defined is attractive and will

serve as a reliable protection of and growth to your pension savings”.

Currency allocation 50% in USD 50% in KZT

Investing 50% of the portfolio into foreign capital markets

Transparent financial activity

No allocation in local sectors where there has been a case of default of a

company

No allocation in affiliate companies

Professional Team

12+

bln tenge

bln tenge

Assets under management

As of

01.01.2023

419+

bln tenge

bln tenge

Client assets in brokerage accounts

As of

01.01.2023

1,52+

trln tenge

trln tenge

Client transactions turnover

As of 01.01.2023

1.0+

trln tenge

trln tenge

Raised capital

time

of the activity

Strategy

The aim of the fund is to preserve and increase pension savings of residents of the Republic of Kazakhstan by

the retirement age.

Fund assets will be invested in liquid public financial instruments, including equities, bonds, exchange-traded funds (ETFs), short-term treasury notes of the National Bank of Kazakhstan, medium-term sovereign bonds of Kazakhstan, as well as precious metals.

Fund assets will be invested in liquid public financial instruments, including equities, bonds, exchange-traded funds (ETFs), short-term treasury notes of the National Bank of Kazakhstan, medium-term sovereign bonds of Kazakhstan, as well as precious metals.

Key figures

Below is information on the portfolio collected as part of the management of pension assets

13%

annual return

annual return

Target investment

income

14,26%

annual return

annual return

Portfolio return for the period 31.01.2023

4 294,85

mln tg

mln tg

Net worth of pension assets under management as of 31.01.2023

0%

Fund management fee

Fund management fee

We do not charge a commission fee on your savings, but only 5% on your

investment income

Asset Allocation

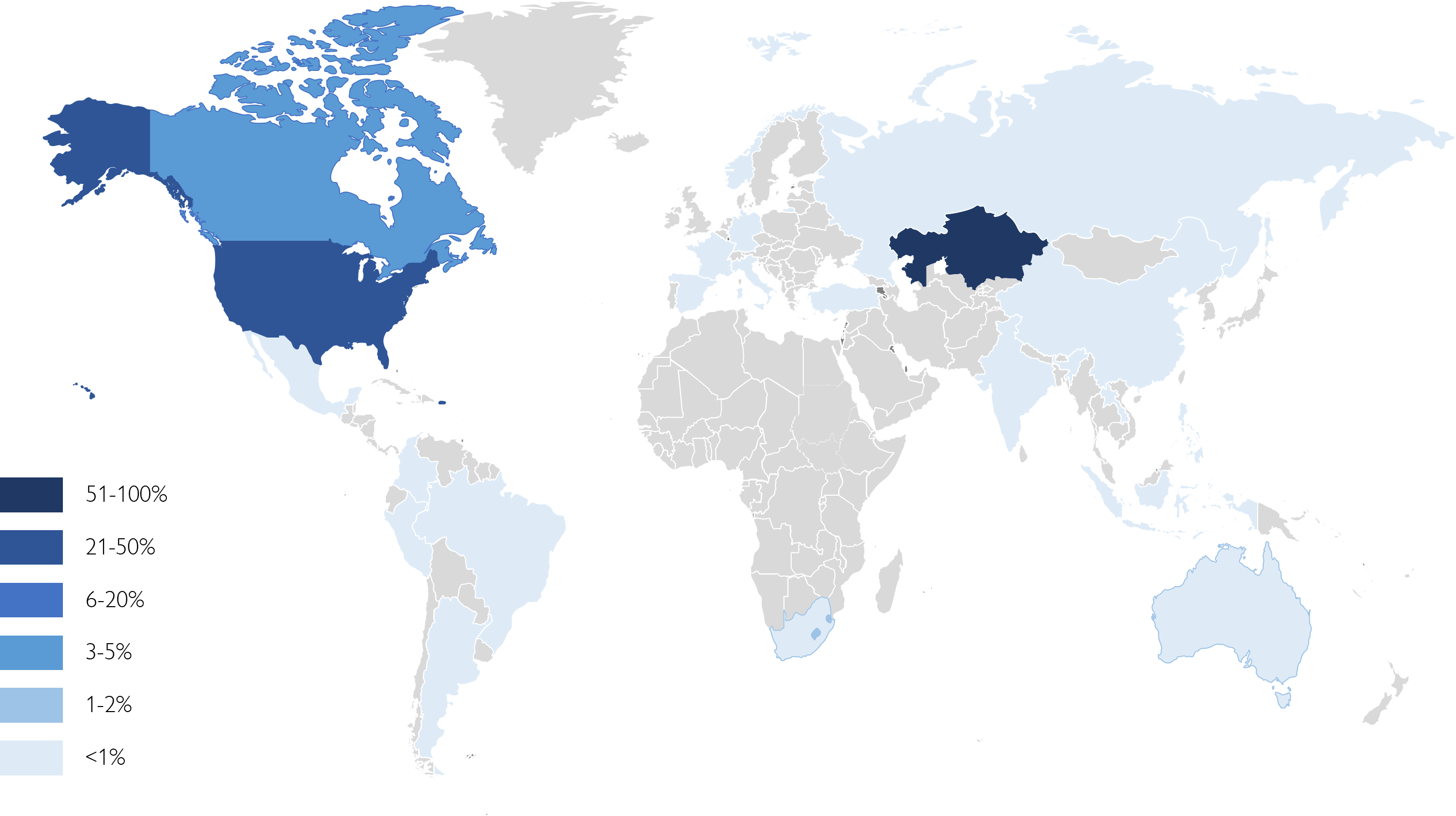

Geographic distribution

Portfolio Investments

Documents

| Bonds of the MFRK | 20,56% | |

| Cost promotions | 1,26% | |

| Real estate funds | 2,64% | |

| World stocks excluding USA | 3,70% | |

| Emerging markets stocks | 3,48% | |

| Gold miners' shares | 4,44% | |

| Notes of NBRK | 29,17% | |

| USA treasury bonds | 8,58% | |

| USA Broad Market Stocks | 7,29% | |

| Shares of the ESG segment (socially responsible investment) | 0,83% | |

| Short-term USA Treasuries | 5,76% | |

| USA floating rate bonds | 2,14% | |

| Cash | 10,17% |

| USD | 40,43% | |

| KZT | 59,57% | |

*По

состоянию на 31.01.2023

How does it work?

1

Choose Jusan Invest in your “Unified Accumulative Pension Fund” (JSC

UAPF) personal account.

Login to your personal account at UAPF and choose to transfer part of your

retirement savings to the asset management by Jusan Invest JSC

2

We invest according to Fund’s strategy

A professional team, following its strategy, invests in reliable and

profitable financial instruments

3

Receive your pension savings and return on investments

When you reach your retirement age receive your pension savings and return

on your investment.

FAQ